April 2020 saw a 60% decrease in cash withdrawals compared with the same month last year, and during the pandemic 75% of British adults have used less cash. With the contactless payment limit being increased from £30 to £45, it’s no surprise that many of the shops that have been able to remain open have asked for people to pay using contactless wherever possible.

But some shops have already gone a step further, and many are preparing to do the same once the lockdown starts to life: Customers can only by card or contactless, they are not accepting cash payments.

So will the Covid-19 crisis spell the end for cash in our society?

We seemed to be already heading that way, but it’s now being suggested that the UK could be cashless within as little as 2 years.

2019’s Access To Cash Review found that the UK could become ‘virtually cashless’ by 2035, but before the lockdown began recent figures were suggesting that it could happen even earlier by 2030. Now with the current pandemic, it could be that this been pushed forward even more.

Experts were expecting a fall in cash use over the next 5 years, but the pandemic seems to be rapidly speeding things up, with figures suggesting that they could instead see the decline happening in the next 5 months.

Despite a consultation due to take place to decide new laws promising to protect access to cash, it’s not clear how Chancellor Rishi Sunak will be doing this, even though it was mentioned in his budget.

A mere 21% of 500 respondents to a British survey on small businesses said that they wouldn’t be abandoning cash payments.

Contactless Payments

Whether or not you can actually become infected via cash, the increase in the use of card and contactless is there from both sides. People may be afraid to handle cash for fear of the virus being transmitted on coins and notes they receive as change, as well as shops restricting cash use to reduce interaction between staff and customers during transactions.

Since March, the UK’s largest supermarkets, including Sainsbury’s and Tesco, have been urging their customers to pay without using cash.

The increase in payment limit for contactless also reduces the use of chip and pin machine keypads; another surface that could potentially harbour and transmit the virus.

Unfortunately, small businesses that are still taking cash are being forced to travel further to deposit their takings due to local bank branches closing. Another factor that could push these businesses towards card only payments.

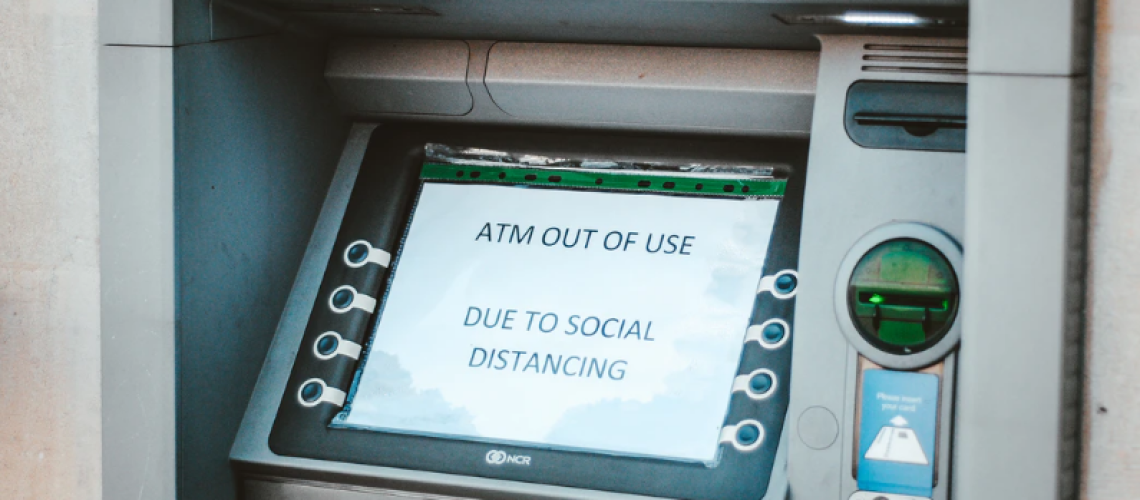

Subsequently, the less people that use cash, the less use there is of ATM’s. This could lead to privately owned and free-to-use ATM’s starting to disappear from out streets, pushing us further towards card only payments.

It could be argued that cash poses no greater threat than the customer touching the shopping trolley handle or pressing the buttons for chip and pin. Yet retailers are expected to only accept cards or contactless payments until the coronavirus is no longer a threat, to their staff as well as customers.

Support for Contactless Payments?

While many will support the use of cards over cash, especially during the pandemic, there are also those that will be negatively affected by this change and seemingly are already starting to struggle.

Charity Age UK have already expressed concerns that the elderly would be among the most vulnerable should we be hurtling towards a cashless society, with a spike in older customers who have used up their cash supplies and thus are afraid they will not be able to buy food and other essentials.

A spokesman for UK Finance commented, saying they have worked hard to make sure that all customers are able to make cash withdrawals during lockdown, isolation and shielding.

Research in 2019 by the Financial Conduct Authority suggested that 1.3 million adults in the UK don’t have a bank account. In addition, even if someone does have a debit or credit card, they may feel uncomfortable giving it to a neighbour or volunteer to do their shopping.

The author of the Access to Cash Review, Natalie Ceeney warns that 20% of the population still require cash, with a large proportion of these people being vulnerable. This includes the elderly, disabled or those on lower incomes.

She insists that as a society, we cannot go cashless until the required infrastructure is in place to protect those who are vulnerable, and everyone is ready.

So will cash be a victim of the virus? The figures are there in black and white – People are using cash significantly less during the pandemic. The question is, once this is all over, will society stick with card and contactless payments and shun the more traditional payment methods?